- Ever wonder if Amer Sports might be a hidden value play, or if the recent hype has already pushed it out of bargain territory?

- The stock has had some eye-catching moves lately, with an increase of 10.5% over the last week and a significant 61.4% rise over the past year. This signals both growth potential and shifting risk perceptions.

- Amer Sports has been making headlines for securing new distribution partnerships and increasing its presence in the premium sportswear market. These developments have likely contributed to the stock’s momentum. Recent media coverage highlights new collaborations with global retailers and expansion into emerging regions, suggesting a strategic push for future growth.

- On our checklist of six key valuation measures, Amer Sports comes in at 2/6 for being undervalued. This means there is more to explore beneath the surface. We will break down different approaches to valuing the company, and at the end, reveal a fresh perspective you might not have considered.

Amer Sports scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Amer Sports Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today using a required rate of return. The idea is to assess what the business is worth based on how much cash it can generate over time.

For Amer Sports, the latest reported Free Cash Flow (FCF) is $225 million. Analyst forecasts extend over the next five years and expect healthy growth. Future cash flows out to 2035 have been extrapolated from trends. In 2029, the projected FCF is $983.5 million. By 2035, estimates reach almost $2 billion. All projections use US dollars.

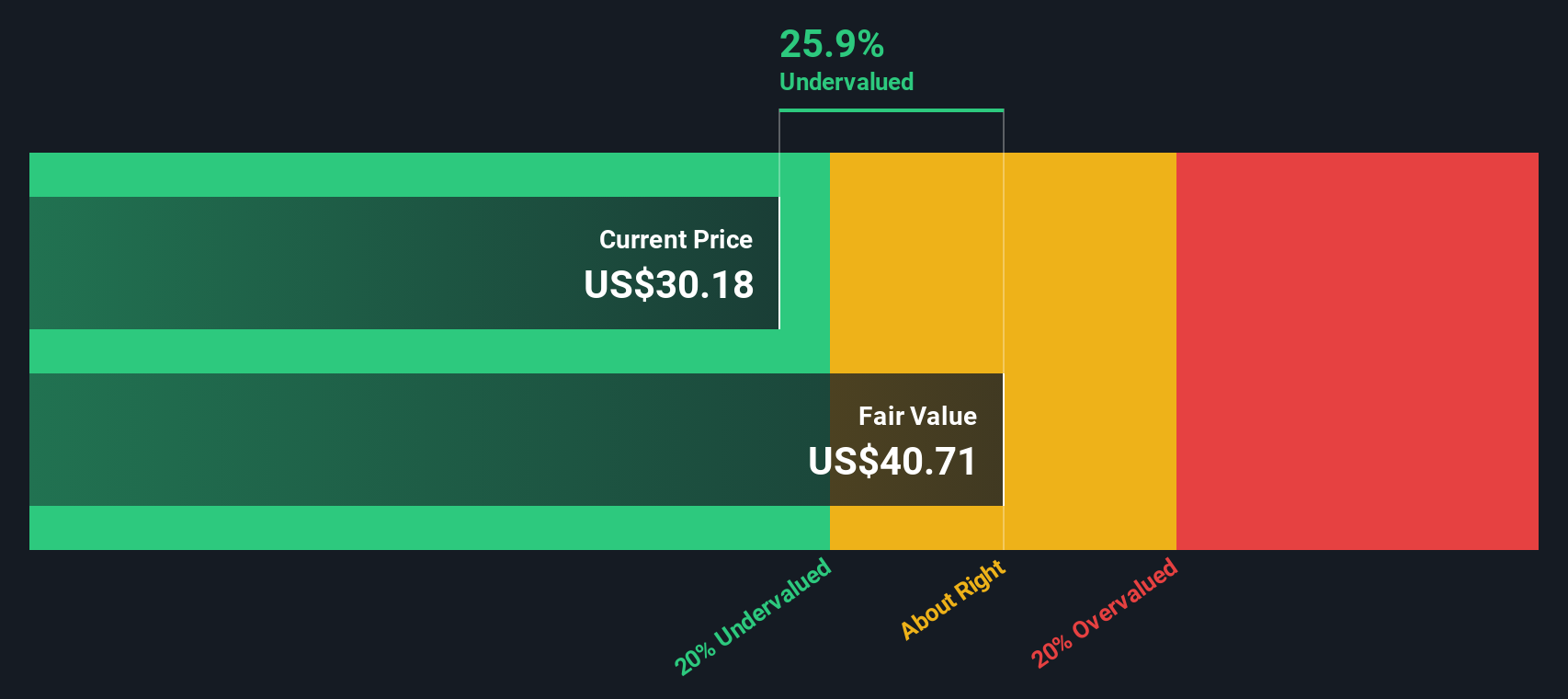

Based on these assumptions, the DCF model calculates Amer Sports’ fair value at $40.55 per share. Given recent market prices, this result implies the stock is trading at a 17.7% discount to its intrinsic value, suggesting that shares are currently undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amer Sports is undervalued by 17.7%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Amer Sports.

Approach 2: Amer Sports Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely followed metrics for valuing profitable companies like Amer Sports. It offers a direct way to measure how much investors are willing to pay today for each dollar of current earnings, making it a powerful tool for assessing valuation, especially when earnings are positive and stable.

Growth expectations and perceived risks play a large role in setting what is considered a “fair” PE ratio. If a company is expected to deliver high earnings growth or operates with lower risk, investors are typically willing to pay a higher multiple. Companies facing uncertainty or slower growth may warrant a discounted ratio.

Amer Sports is currently trading at a PE ratio of 82.6x, which looks elevated compared to both the industry average of 19.2x and the peer average of 31.8x. At first glance, this could signal an overvalued stock. However, the “Fair Ratio” calculated by Simply Wall St for Amer Sports is 23.9x. This Fair Ratio incorporates not just standard earnings comparisons but also factors in Amer Sports’ expected earnings growth, its industry position, profit margins, as well as its market cap and company-specific risks.

The Fair Ratio provides a deeper perspective than simply benchmarking against peers or industry averages because it customizes what a reasonable valuation multiple should look like for Amer Sports’ unique situation. When comparing the company’s actual PE of 82.6x to the Fair Ratio of 23.9x, there is substantial overpricing based on Simply Wall St’s holistic assessment.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amer Sports Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your own story or viewpoint about a company, informed by how you interpret its business prospects, growth potential, risks, and financial outlook.

Unlike traditional methods that focus only on the numbers, Narratives connect the dots between the company’s story, a tailored financial forecast, and the resulting fair value. This approach makes your investment process more personal and insightful.

On Simply Wall St’s Community page, millions of investors use Narratives as an intuitive and dynamic tool to express their perspectives on companies like Amer Sports. Narratives let you compare your estimated fair value to the current share price. This gives you a clear decision point for when to buy, hold, or sell based on your unique view of the business.

As new news or company updates emerge, Narratives are automatically refreshed so your analysis always reflects the latest developments. For Amer Sports, for example, one investor may create a bullish Narrative, expecting revenue and earnings to outperform and assigning a fair value as high as $52. A more cautious investor may highlight risks around margin pressure and competitive threats, valuing the stock closer to $34.

Do you think there’s more to the story for Amer Sports? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

link