Needham has initiated coverage of Columbia Sportswear (COLM, Financial) with a Hold rating, citing the uncertain macroeconomic environment as a reason for their cautious stance. While the outdoor sector is positioned for promising long-term growth, the current economic landscape remains unstable, making it difficult to be optimistic in the short term.

According to analysts, Columbia’s strong financial foundation is a plus, but wholesale partners might exercise caution when ordering inventory for the latter part of 2025 due to economic concerns. Additionally, Columbia’s competitive pricing strategy may face challenges if inflation resurfaces later this year, potentially impacting its market position against other outdoor industry players.

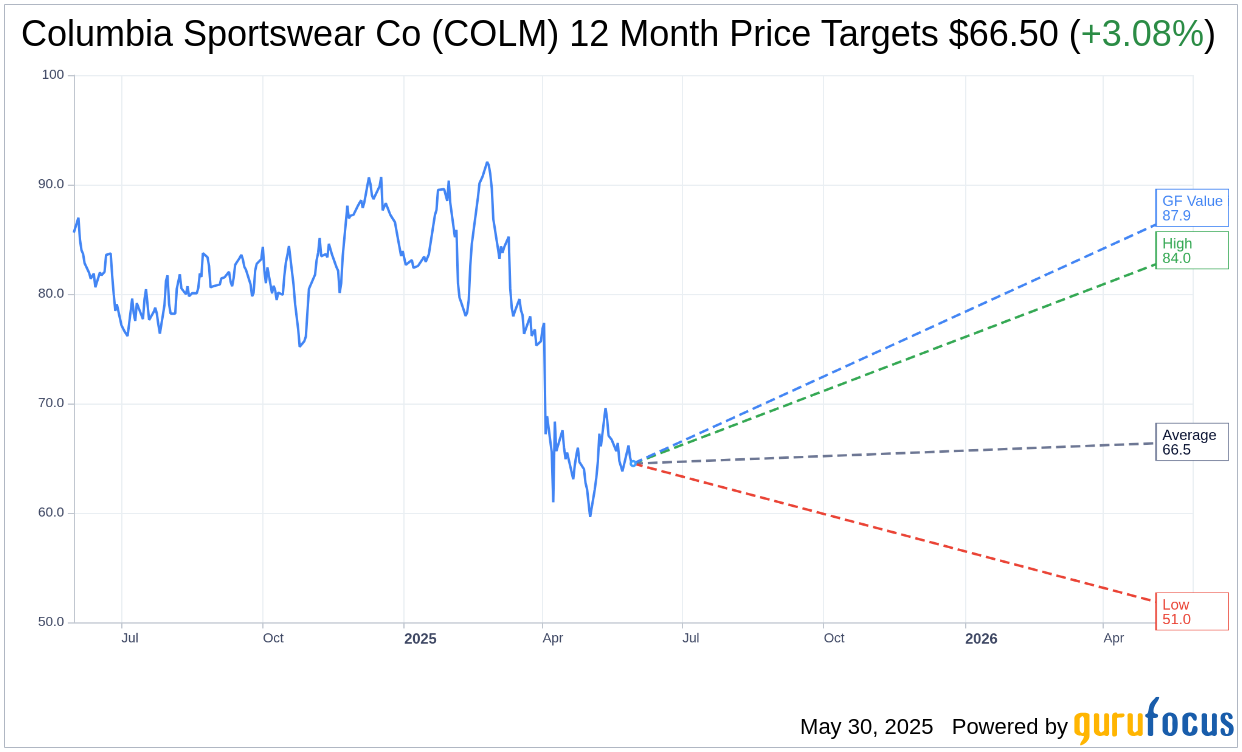

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Columbia Sportswear Co (COLM, Financial) is $66.50 with a high estimate of $84.00 and a low estimate of $51.00. The average target implies an

upside of 3.08%

from the current price of $64.51. More detailed estimate data can be found on the Columbia Sportswear Co (COLM) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Columbia Sportswear Co’s (COLM, Financial) average brokerage recommendation is currently 2.9, indicating “Hold” status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Columbia Sportswear Co (COLM, Financial) in one year is $87.88, suggesting a

upside

of 36.23% from the current price of $64.51. GF Value is GuruFocus’ estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business’ performance. More detailed data can be found on the Columbia Sportswear Co (COLM) Summary page.

COLM Key Business Developments

Release Date: May 01, 2025

- Net Sales: Increased 1% year over year to $778 million.

- Wholesale Net Sales: Increased 2%.

- Direct-to-Consumer Sales: Flat performance.

- Gross Margin: Expanded 30 basis points to 50.9%.

- SG&A Expenses: Increased 1%.

- Diluted Earnings Per Share: $0.75, up 6% year over year.

- US Net Sales: Decreased 1%.

- LAAP Net Sales: Increased 14%.

- EMEA Net Sales: Increased 7%.

- Canada Net Sales: Decreased 2%.

- Columbia Brand Net Sales: Increased 3%.

- Mountain Hardware Net Sales: Decreased 14%.

- prAna Net Sales: Decreased 10%.

- SOREL Net Sales: Decreased 8%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Columbia Sportswear Co (COLM, Financial) exceeded its guidance range for first-quarter net sales and earnings.

- The company’s international markets showed strong performance, with double-digit growth in the LAAP region and high single-digit growth in the EMEA region.

- Columbia Sportswear Co (COLM) has a diversified supply chain and a team with deep international trade experience, which helps mitigate the impact of US tariffs.

- The company is committed to increasing investment in demand creation and launching a new global marketing platform to enhance brand engagement.

- Columbia Sportswear Co (COLM) has a strong balance sheet and is well-positioned to gain market share during periods of rising prices for US consumers.

Negative Points

- The company faces significant uncertainty due to recent US tariff increases, impacting its ability to confidently plan and invest in the US market.

- Columbia Sportswear Co (COLM) has withdrawn its full-year 2025 outlook due to the heightened uncertainty regarding tariff rates and their impact on product costs and consumer demand.

- The US market is expected to be challenging in the back half of the year, with higher prices potentially impacting consumer demand.

- The company anticipates absorbing much of the incremental tariff costs in 2025, which could affect profitability.

- Columbia Sportswear Co (COLM) is planning its US business conservatively to minimize inventory risk and preserve profitability amid uncertain market conditions.